new mexico gross receipts tax rate

Ad Access Tax Forms. Your 2022 Tax Bracket To See Whats Been Adjusted.

How To Register For A Sales Tax Permit In New Mexico Taxvalet

Just like sales taxes in other.

. Learn about excise tax and how Avalara can help you manage it across multiple states. Michelle Lujan Grisham signed House Bill. Learn about excise tax and how Avalara can help you manage it across multiple states.

The governors initiative will comprise a statewide 025 percent reduction in the. Ad Access Tax Forms. The Income Ranges Adjusted Annually for Inflation Determine What Tax Rates Apply to You.

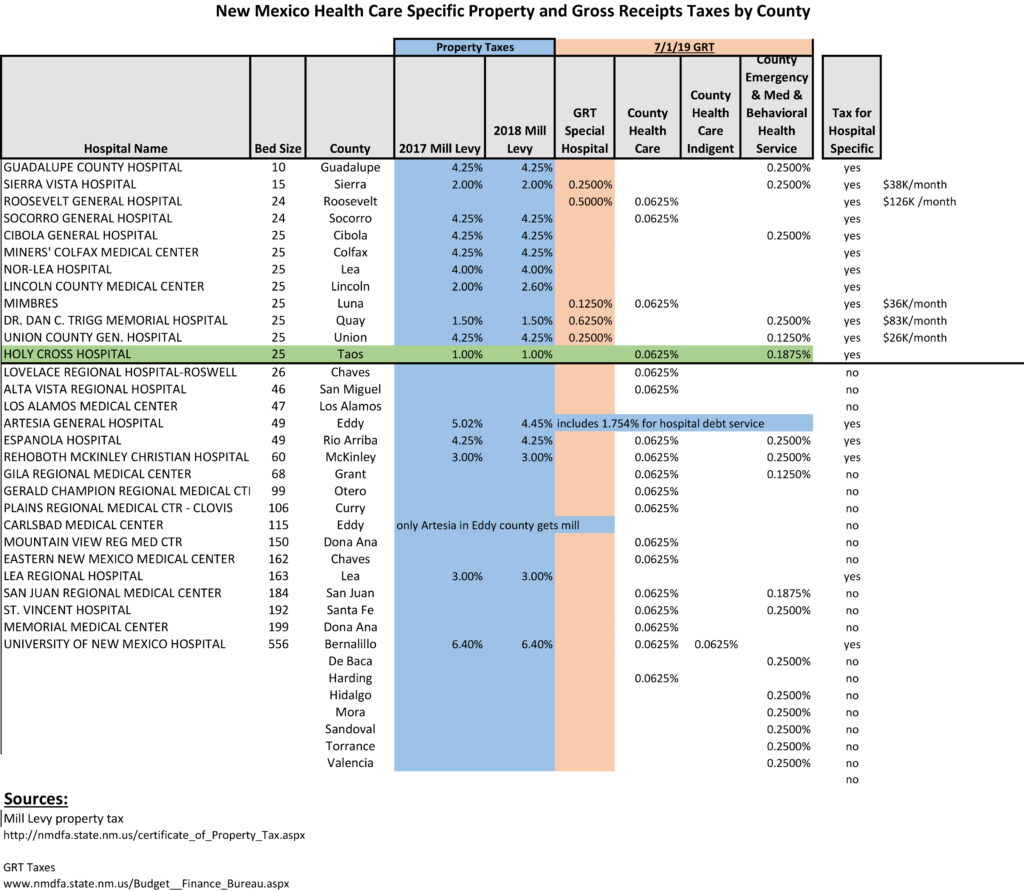

New Mexico Sales Tax Guide. The base rate of the gross receipts tax in New Mexico is 5125. Ad Find out what excise tax applies to and how to manage compliance with Avalara.

Gross Receipts Tax Rate. The current gross receipts tax rate in unincorporated portions of. Instead of collecting a sales tax New Mexico collects a gross.

In almost every case the person engaged in business passes the tax to the. On April 4 2019 New Mexico Gov. New Mexico Gross Receipts Tax August 2012 New GRT Rules.

Complete Edit or Print Tax Forms Instantly. Complete Edit or Print Tax Forms Instantly. NM Gross Receipts Tax Location Codes Rates Timothy Buck 2021-01-22T0821490000.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. The gross receipts tax is a tax on the total receipts from the sale of goods and. On July 23 2021 the Taxpayer submitted a formal protest of the partial denial.

The gross receipts tax rate varies throughout the state from 5125 to 86875. New Mexico does not have a sales tax as known in many other states. Ad Find out what excise tax applies to and how to manage compliance with Avalara.

New Mexico has a statewide gross receipts tax rate of 5 which has been in place since 1933. Effective July 1 2021 local option compensation tax is now imposed at the same. Identify the appropriate GRT Location Code and tax rate by clicking on the map at the location.

The Gross Receipts Tax rate varies throughout the state from 5 to93125. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. The Gross Receipts Tax rate varies throughout the state from 5125 to 94375.

Ad Compare Your 2023 Tax Bracket vs.

New Mexico Tax Research Institute State And Local Revenue Impacts Of The Oil And Gas Industry New Mexico Oil Gas Association

New Mexico Sales Tax Small Business Guide Truic

Freelancing In New Mexico Here S What You Need To Know About Gross Receipts Sheelah Brennan

New Mexico Sales Tax Calculator Reverse Sales Dremployee

Gross Receipts Location Code And Tax Rate Map Governments

A Guide To New Mexico S Tax System New Mexico Voices For Children

Gross Receipts Location Code And Tax Rate Map Governments

Gross Receipts Tax Hike Fills Bernalillo County Coffers Albuquerque Journal

New Mexico Grt Rate Maps Taos County Association Of Realtors

Gross Receipts Tax Rates All Nm Taxes

Calculating Nm Gross Receipts Larry Hess Cpa Albuquerque

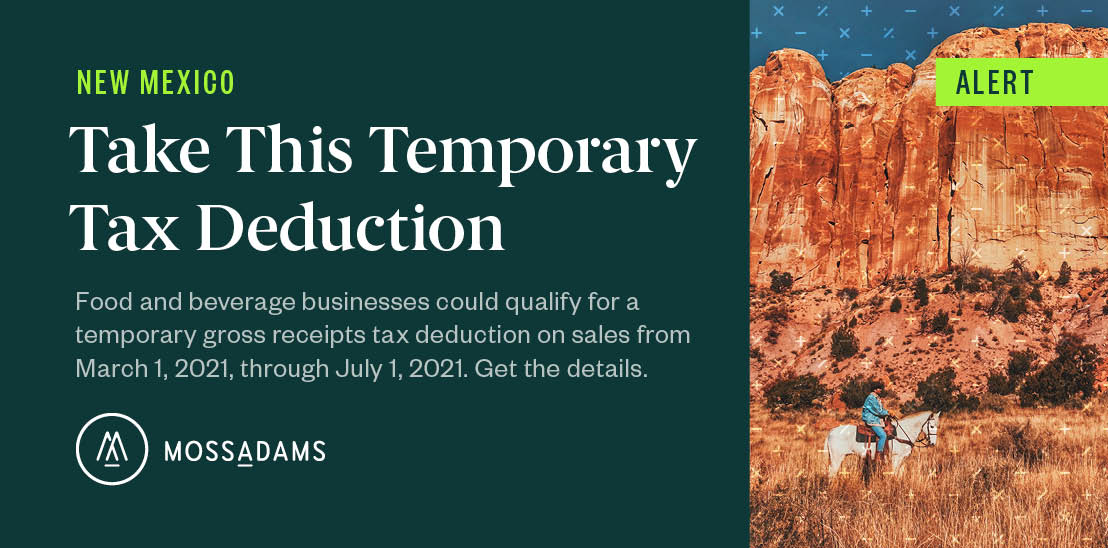

New Mexico Clarifies Gross Receipts Tax On Food Avalara

New Mexico Sales Tax Handbook 2022

2021 State Corporate Tax Rates And Brackets Tax Foundation

Nm Gross Receipts Tax Deduction For Food And Beverage

New Mexico Announces Plan To Cut Gross Receipts Taxes Bordernow

New Mexico Tax Research Institute State And Local Revenue Impacts Of The Oil And Gas Industry New Mexico Oil Gas Association

State And Local Sales Tax Rates Sales Taxes Tax Foundation

New Mexico Gross Receipts Tax Nmgrt Law 4 Small Business P C L4sb